In most instances when debt is issued, there are costs associated with the issuance that may be capitalizable under US GAAP. While we won’t cover the particular capitalizable costs in this blog posting or cover classification of these costs (we’ll highlight these items in a subsequent blog post), we’ll cover how these costs should be amortized for term loans and revolvers.

First, let’s take a look at the relevant guidance within the Accounting Standards Codification (ASC) for term loans:

ASC 835-30-35-2: With respect to a note for which the imputation of interest is required, the difference between the present value and the face amount shall be treated as discount or premium and amortized as interest expense or income over the life of the note in such a way as to result in a constant rate of interest when applied to the amount outstanding at the beginning of any given period. This is the interest method.

ASC 835-30-35-4: Other methods of amortization may be used if the results obtained are not materially different from those that would result from the interest method.

The above guidance indicates that the interest method, also known as the effective interest method, must be used to amortize the debt issuance costs. However, if another method does not result in a material difference from the effective interest method, it may be used. The alternative method is typically the straight-line method.

Note that this guidance does not apply to debt recorded at fair value, but only debt recorded at cost. Also, the above guidance is generally applicable for term debt issued at a discount (also known as an original issue discount (OID)).

For revolvers, amortization of debt issuance costs is straight-line in nature. For both term loans and revolvers, the amortization period of the debt issuance costs is generally the contractual length of the debt.

Spreadsheet for Amortization

The attached file is a standard amortization template that may be used for term loans and revolvers. The first tab of the file is used for term loans using the effective interest method, while the second tab is used for term loans and / or revolvers using the straight-line method.

The second tab is more simplified than the first as only a few inputs are necessary. The key inputs include the total amount of debt issuance costs and the months of amortization. Note that if the months of amortization vary from this standard template, which uses 60 months, additional months can be added or months can be taken away. A good check is to ensure that the ending balance of the debt issuance costs, net (column G) is $0 in the last period of amortization.

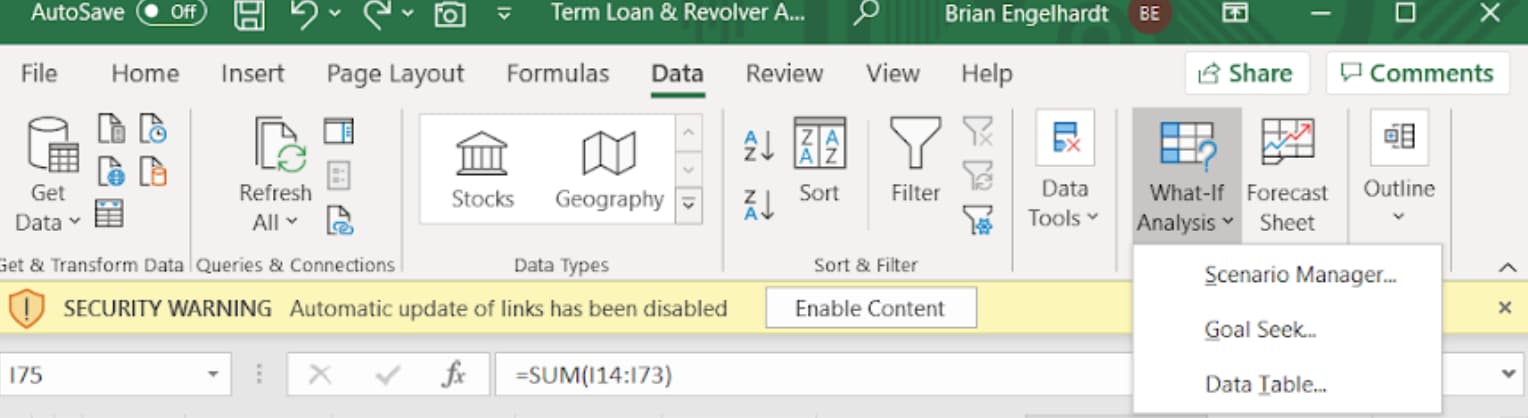

The first tab has a bit more going on than the second tab due to the effective interest method being used. The inputs in this tab include the face amount of the term loan, the total debt issuance costs, the stated interest rate at the time of issuance, and the payment schedule (column E). Similar to the second tab, this schedule is formula-driven but there may be some edits needed to ensure formulas carry down to the bottom if the contractual period of the loan differs from five years. To calculate amortization (column I), the use of a formula called Goal Seek is necessary. Goal Seek enables amortization to be calculated and sum, in total, to the total debt issuance costs, by changing the effective interest rate. Goal Seek can be found in the “Data” tab and then “What if Analysis”:

Once selected, a box will pop up with three fields to populate. In summary, we want to set the sum of column I (the amortization of debt issuance costs) equal to the total debt issuance costs by changing the effective interest method. Using the example file attached, the Goal Seek pop up would be populated as follows:

Similar to the second tab, there are a couple of checks that can be used to ensure the calculations are working properly; columns J, K, and P should all have a $0 balance in the last period of amortization.

One nuance to think about is whether the interest rate for the term loan will remain the same throughout the contractual life of the debt or will change. If the interest rate will remain the same, this schedule can be set up at inception of the agreement with no changes subsequently required. If the interest rate will change (an example is if LIBOR is used), the schedule may need to be updated monthly. To update in this scenario, copy and paste values of all previous months, update the stated interest rate, and then re-run the Goal Seek formula.

For more information on this or, for any of your accounting or decision making needs, schedule a FREE CONSULTATION with us at www.BalancedSolutions.Pro.